Thank you Katina for the opportunity to connect on this.

The Economy Strikes Back Against Coronavirus: Interview With Noah Kindler, Former Executive At Canoo And Knotel

GETTY

The increased probability that the coronavirus has spread beyond China to become a global pandemic halted equities’ seemingly unstoppable rally. In the last couple of days the S&P 500 fell by 6.5%, the largest loss since August 2019. The first line of defense supporting risky assets such as equities is “Helicopter money”, with both the government of Hong Kong and the government of Singapore recently announcing that they will give out cash to their citizens to assuage market concerns related to the coronavirus.

However, investors have concerns whether the global economy will be able to quickly recover from the impact of coronavirus. Below, I interview Noah Kindler, an expert in innovation and entrepreneurship to explore his views of whether the global economy is resilient enough to withstand the impact of coronavirus.

Noah Kindler is an experienced entrepreneur and innovator. He has founded and led product innovation at companies in both the consumer and enterprise markets including for Canoo and Knotel, which are both unicorns. He has a BS in Computer Science from Stanford and an MBA from Harvard.

Today In: Money

Stefanova: Noah, it is a pleasure to talk to you. Please tell me, what do you believe will be the long term economic reaction from the coronavirus? Can you draw some historical parallels to predict the types of innovation that could potentially arise as a result of coronavirus?

Kindler: I am optimistic about the global economy’s ability to adapt to the coronavirus threat. The combined power of innovation and entrepreneurship can not only halt the advancement of the coronavirus, but also create a global economy far more resilient to future pandemics. Such optimism is grounded in history.

Just as 20 years ago after September 11th, out of fear and sadness, the US and global economy emerged stronger than ever. We saw industry create a whole new class of services and technologies, which were desperately needed to address the threat of terrorism: security screening, identity and intelligence products. Arguably, some of the most impactful technologies such as AI, data analytics, face recognition, voice recognition were propelled forward by government research and venture capital specifically as a result of the rising threat of terrorism. The impact of the coronavirus is similar in its ability to incentivize innovation. Today, with the risk of global pandemics on the forefront of both governments and business, we’re seeing a need for rapid innovation to help patients and care providers; to address business continuity, and government security — and many of these just do not yet exist.

Stefanova: Noah, based on your entrepreneurship and Venture Capital experience, what areas specifically are you looking at as potential emerging business models to protect the world from the risk of pandemic? As a result, which public and private companies should investors look to invest into.

Kindler: I see five areas which are simply needed now, more than ever, and will be needed even more in the future with increasing internationalization.

New treatments: Vaccines and medications to treat pandemics and quickly tweak and distribute optimized formulations as required, like for the flu every year. This will boost pharmaceutical research and increase government investment in the area. Also the ability to produce such treatments on demand and in large quantities as well as transport them efficiently to wherever in the world infection spreads will create an opportunity for new and creative medical companies. The innovation has already begun with companies such as Gilead (70.10 USD), Inovio (3.74 USD), Moderna (23.76 USD) leading the way. For example, Gilead came up with a drug that can help treat coronavirus symptoms, and Inovio and Moderna started to develop coronavirus vaccines.

Diagnostic equipment: Diagnostics equipment that is effective and inexpensive, can be used by non-medical professionals such as airport personal or self administered simply does not exist. Investors should look for companies that are developing screening equipment to quickly discover people who may be ill or carrying a virus, and should be isolated from groups: first level, secondary, etc. These technologies can be customized for their environments, be it a hospital, airport, church or even at home.

Spread reduction technologies: As we’ve seen on cruise ships, their ventilation systems are woefully inadequate to contain and isolate infections. Various air filtration and other protective equipment is needed urgently. This equipment may have the ability to quickly upgrade protective capabilities as needed.

Inventory stockpiling and pre-positioning: In 2001, when the anthrax scare was at its peak, people were stockpiling the antibiotic Cipro. And, recently, we saw China urgently build a large isolation hospital in under a week. I imagine a word where stockpiles of such inventory are built up and maintained as needed. New types of logistics and storage companies may arise as a result.

Financial products: I’ve watched my 401k drop almost 10% as a result of the coronavirus. I hear of hedge funds changing their trades based upon this. It turns out that I, like almost everyone, was long ‘no-pandemic.’ While the people who are sick are the true tragedy, we shouldn’t overlook that this virus has wreaked havoc on people’s retirement security. Additionally, airlines are predicted to lose $30B and other industries like cruises and conferences are sure to suffer. Even Apple’s stock has lost $50B of market cap from this virus. As such, individuals and industries will want to diversify, to varying extents with targeted financial products.

Stefanova: What specific financial products should investors add to their portfolio?

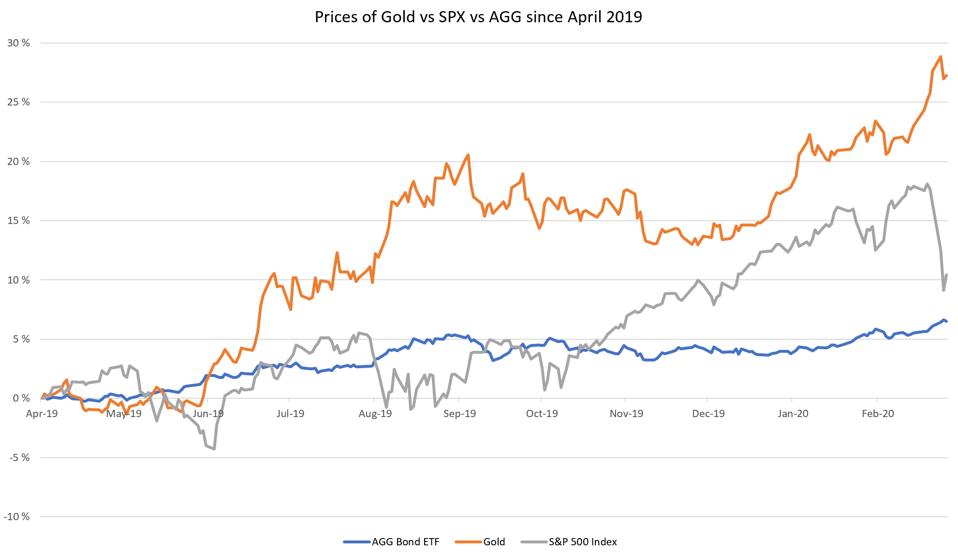

Kindler: I see a need for adding assets to investor portfolios that provide protection in case of pandemic. The simplest way for retail investors in this environment is to reduce volatility by selling some of their equity exposure and adding gold ETFs (SPDR Gold Trust, iShares Gold Trust, Aberdeen Standard Physical Swiss Gold Shares ETF). Katina you have written about precious metals and unlevered real assets recommending to investors to add those to their portfolios as one of the core macro themes for 2020. Additionally, you predicted that gold will outperform both equities and bonds as early as April 2019 (3 Reasons Why Gold Will Outperform Equities and Bonds). It is not too late for investors to buy gold even now.

MARTO RESEARCH

Stefanova: Noah, are you seeing entrepreneurs start to look at these areas?

Kindler: It’s early, but I’m starting to hear of various bits and pieces here. I would expect to hear more over the next 18 months, especially depending on whether the coronavirus becomes a pandemic. There for the time for investors to adjust their portfolio is now.

Stefanova: Can you share any other thoughts on the coronavirus?

Kindler: It’s a tragedy foremost. My heart goes out to those affected. The front line workers are heroes and do not get enough credit. I hope in the future that patients and workers have even better opportunities and outcomes. However, I am an optimist and we have seen over and over the global economy adapting to quickly to respond to new threats again and again through the power of technology innovation and entrepreneurship. This time it is no different.

No comments:

Post a Comment